Why Most People Fail at Saving Money sets the stage for this exploration into the various hurdles many encounter on their saving journey. From psychological barriers to lifestyle choices, this narrative delves into the nuances of why saving often feels like an uphill battle. By understanding these challenges, we can better equip ourselves to tackle them head-on and foster a healthier financial future.

In a world where instant gratification reigns, many find themselves ensnared by impulse spending and financial mismanagement. This discussion will shed light on the common misconceptions surrounding budgeting, highlight the importance of setting realistic financial goals, and present effective strategies for cultivating a sustainable saving habit.

Common Reasons for Financial Inability

Many individuals struggle with saving money due to a combination of psychological, lifestyle, and societal factors. Understanding these barriers can help people identify their habits and work towards better financial health. Recognizing why people often fail at saving money is the first step towards making the necessary changes for financial success.

One of the major issues lies in our mindset towards money. Psychological barriers, such as fear of missing out or the desire for instant gratification, can derail even the best-laid plans for saving. Additionally, lifestyle choices that prioritize immediate pleasures over long-term financial stability often impede growth. Social pressures further complicate saving habits, as individuals feel compelled to keep up with peers or maintain a certain image.

Psychological Barriers to Saving

The way we think about money greatly influences our saving behavior. Several psychological factors can hinder effective saving, including:

- Fear of Scarcity: Many individuals are driven by a fear of not having enough, which can lead to hoarding money rather than saving it effectively. This mindset can create anxiety about spending even on necessities.

- Instant Gratification: The desire for immediate pleasure often outweighs the long-term benefits of saving. This can manifest in impulse buying or lifestyle inflation, where individuals spend more as their income increases.

- Negative Self-Perception: Some people believe they are bad with money and thus are less likely to engage in saving practices or even seek financial advice.

Lifestyle Choices Impacting Financial Growth

Lifestyle choices play a pivotal role in financial health. Making decisions that prioritize short-term satisfaction can significantly impact savings. Important factors include:

- High Living Expenses: Many individuals choose to live in expensive areas or invest in costly lifestyles that leave little room for savings. Living beyond one’s means is a common pitfall.

- Lack of Budgeting: Failing to set a budget can lead to overspending. Without clear financial goals and limits, saving becomes much more challenging.

- Neglecting Financial Education: A lack of understanding about money management can lead to poor financial decisions. Individuals who do not invest time in learning about personal finance may miss opportunities to save.

Societal Pressures Affecting Saving Habits

Societal influences can create unrealistic expectations regarding spending and saving. These pressures often manifest through:

- Keeping Up with Trends: The constant exposure to lifestyle influencers and marketing can drive individuals to spend more on items that are deemed necessary by societal standards, thereby reducing their saving potential.

- Peer Pressure: The desire to fit in or impress others can lead to unnecessary expenditures. Individuals may feel compelled to spend beyond their means to align with their social circles.

- Social Media Influence: Platforms that showcase lavish lifestyles can create a false narrative about the need for luxury, pushing individuals to prioritize appearance over financial health.

“True financial independence comes from understanding and overcoming the psychological, lifestyle, and societal barriers that impede saving.”

Financial Illiteracy and Mismanagement

Many individuals struggle with effective money management, often due to a lack of understanding regarding financial concepts. This leads to poor budgeting practices and ineffective saving strategies, which can severely impede their ability to build wealth and achieve financial security. By addressing these misconceptions and providing better education around personal finance, we can help individuals make informed decisions that positively impact their financial futures.

Common misconceptions about budgeting include the belief that it is a restrictive practice that only focuses on cutting expenses. In reality, budgeting is a strategic tool that allows for better spending decisions while also setting aside money for savings and investment. Many people also mistakenly believe that budgeting is only necessary for those in financial trouble. However, effective budgeting is beneficial for everyone, regardless of their financial situation. It helps individuals track their spending, recognize patterns, and adjust their habits to align with their financial goals.

Improving Personal Finance Education, Why Most People Fail at Saving Money

Enhancing financial literacy is crucial for successful money management. Here are several effective methods to improve personal finance education:

- Online Courses: Many platforms like Coursera and Udemy offer free or low-cost courses on budgeting, saving, and investing. Participants can learn at their own pace and gain valuable insights into personal finance management.

- Workshops and Community Programs: Local libraries and community centers often host free workshops that cover essential personal finance topics. These interactive sessions allow individuals to ask questions and engage with experts in the field.

- Reading Books and Articles: Numerous books on personal finance, such as “The Total Money Makeover” by Dave Ramsey, provide strategies for budgeting and saving. Websites like Investopedia also offer a wealth of articles that explain financial concepts clearly.

- Podcasts and Webinars: Financial podcasts and webinars can offer ongoing education through expert interviews and discussions. They make learning about finance accessible and convenient for busy individuals.

Utilizing a mix of these resources can significantly enhance one’s understanding of personal finance.

Budgeting Tools and Apps

There are various tools and applications available that can aid in effective financial management. These tools help individuals track expenses, create budgets, and save money effortlessly. Here are some noteworthy options:

- Mint: This free budgeting app allows users to link their bank accounts, track spending, and set up budgets. Mint automatically categorizes transactions and sends alerts for unusual spending, making it easier to stay on top of finances.

- YNAB (You Need a Budget): YNAB offers a proactive approach to budgeting, encouraging users to assign every dollar a job. This app also provides resources for learning effective budgeting techniques and achieving financial goals. It comes with a subscription fee but offers a free trial.

- PocketGuard: PocketGuard helps users understand how much disposable income they have available for spending after accounting for bills, goals, and necessities. This app simplifies budgeting by showing how much money is left to spend, promoting mindful spending habits.

- GoodBudget: A digital envelope budgeting system that lets users allocate funds into different categories for spending. This method encourages users to stick to their budget by visualizing their financial limits.

These tools not only simplify budgeting but also promote financial awareness and discipline, essential for successful money management.

The Role of Impulse Spending

Impulse spending can significantly derail an individual’s financial stability. Many people find themselves making spontaneous purchases that often lead to regret later. These unplanned expenditures can accumulate quickly, leading to credit card debt and an inability to save money effectively. Understanding impulse spending is crucial for anyone wanting to maintain a healthy financial life and achieve their saving goals.

Impulse buying impacts overall financial health by diverting funds from necessary expenses and savings. It often stems from emotional triggers or marketing tactics designed to create a sense of urgency. When individuals give in to these temptations, they may overspend, leading to regret and increased financial stress. Regular impulse purchases can create a cycle of financial insecurity, preventing individuals from reaching their long-term financial goals.

Recognizing and Controlling Impulse Purchases

Identifying and managing impulse purchases is essential for better financial health. Here’s a step-by-step guide to help curb this behavior:

1. Awareness: Keep a spending diary or use an app to track all purchases. This can help identify patterns in spending habits, particularly those made on impulse.

2. Pause Before Purchase: Implement a waiting period before making any unplanned purchase, such as 24 hours. This gives time to assess whether the item is genuinely needed.

3. Set a Budget: Allocate a specific amount of money for discretionary spending each month. This keeps impulse purchases within a controlled limit.

4. Identify Triggers: Recognize what typically prompts impulse buying, whether it’s stress, boredom, or advertising. Understanding triggers can help develop strategies to avoid them.

5. Visualize Goals: Keep financial goals visible, such as a savings target or debt repayment plan. This serves as a reminder of what is important and why cutting back on impulse buys is necessary.

Strategies to Curb Impulsive Spending Behaviors

Various strategies can effectively reduce impulsive spending behaviors. Here are some approaches to consider:

– Cash-Only Method: Use cash instead of credit or debit cards. This method makes it more tangible and limits overspending since once the cash is gone, no more purchases can be made.

– Limit Access to Temptations: Unsubscribe from promotional emails and avoid shopping websites that encourage impulse buys. Reducing exposure to advertising decreases the likelihood of making spontaneous purchases.

– Create a Wishlist: Maintain a wishlist for items you may want. Instead of buying immediately, revisit it after a set time to see if the desire persists.

– Accountability Partner: Share financial goals with a friend or family member. Having someone to discuss major purchases with can discourage impulse spending.

– Mindfulness Practices: Engage in mindfulness techniques, such as meditation, to enhance self-control and emotional regulation, which can mitigate impulsive buying urges.

By implementing these strategies, individuals can foster better financial habits that align with their savings goals while reducing the impact of impulse spending on their overall financial health.

Goal Setting and Planning for Savings

Setting realistic financial goals is crucial for anyone looking to improve their saving habits. Without clear objectives, it can be easy to lose focus and motivation. Defining specific, measurable, achievable, relevant, and time-bound (SMART) goals helps individuals stay on track and make informed decisions about their finances. This structured approach transforms saving from a vague aspiration into a tangible plan.

Creating a comprehensive savings plan can simplify the process of accumulating wealth. A well-organized plan Artikels how much money needs to be saved, identifies what it will be used for, and sets deadlines for achieving these savings. Such a plan encourages discipline and consistency, making it easier to reach financial milestones.

Importance of Setting Realistic Financial Goals

Establishing realistic financial goals helps maintain motivation and accountability. Here are key points to consider when setting these goals:

- Goals should reflect personal values and priorities, ensuring they resonate on a personal level. For instance, if travel is a priority, setting a savings target for a dream vacation can be motivating.

- Goals must be attainable and realistic based on an individual’s current financial situation. For example, saving $5,000 in one month may be unrealistic for many, whereas setting a target of $500 a month could be feasible.

- Short-term and long-term goals should be balanced, allowing for immediate gratification while also planning for future needs. A combination of saving for an emergency fund and a retirement account ensures a well-rounded financial approach.

Organizing a Comprehensive Savings Plan

Developing a structured savings plan involves several steps. A clear Artikel aids in tracking progress and adjusting as necessary. The following elements are essential in any savings plan:

- Assess Current Financial Situation: Analyze income, expenses, and existing savings to determine a realistic starting point.

- Set Specific Goals: Identify clear and specific objectives, such as saving for a home down payment or an emergency fund.

- Create a Budget: Establish a monthly budget that allocates funds to savings while managing expenses effectively.

- Automate Savings: Set up automatic transfers to savings accounts to ensure consistent contributions without the temptation to spend.

- Monitor Progress: Regularly review savings goals and adjust plans as needed to stay on track or respond to changing circumstances.

Success Stories of Changed Saving Habits

Real-world examples highlight the effectiveness of structured savings plans. Consider Emily, who transformed her financial situation by setting a goal to save for a wedding. She developed a detailed budget and automated her savings, achieving her target within two years. Another inspiring case is of Mark, who initially struggled with debt but sought financial education. By creating a savings plan focused on debt repayment followed by savings for a home, he successfully became a homeowner within five years.

“Transforming saving habits through structured planning not only improves financial stability but also enhances overall peace of mind.”

These stories illustrate that with the right planning and dedication, anyone can change their financial trajectory and achieve their savings goals.

Final Summary

As we wrap up our journey through the reasons behind why most people fail at saving money, it becomes clear that awareness is the first step toward change. By recognizing the psychological and societal pressures at play, along with embracing better financial education and disciplined spending practices, anyone can take control of their savings. Remember, the path to financial stability is not just about saving; it’s about creating a comprehensive plan that works for you and adapting it as life evolves.

Clarifying Questions: Why Most People Fail At Saving Money

What are the psychological barriers to saving?

Psychological barriers include fear of scarcity, immediate gratification, and lack of financial education, all of which can deter effective saving habits.

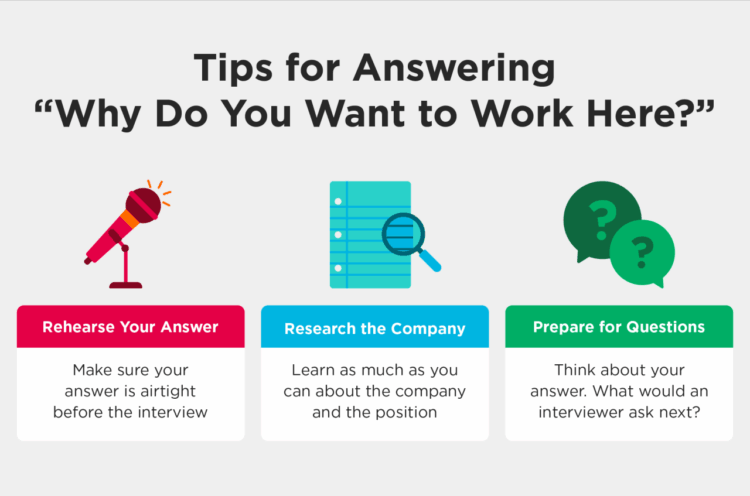

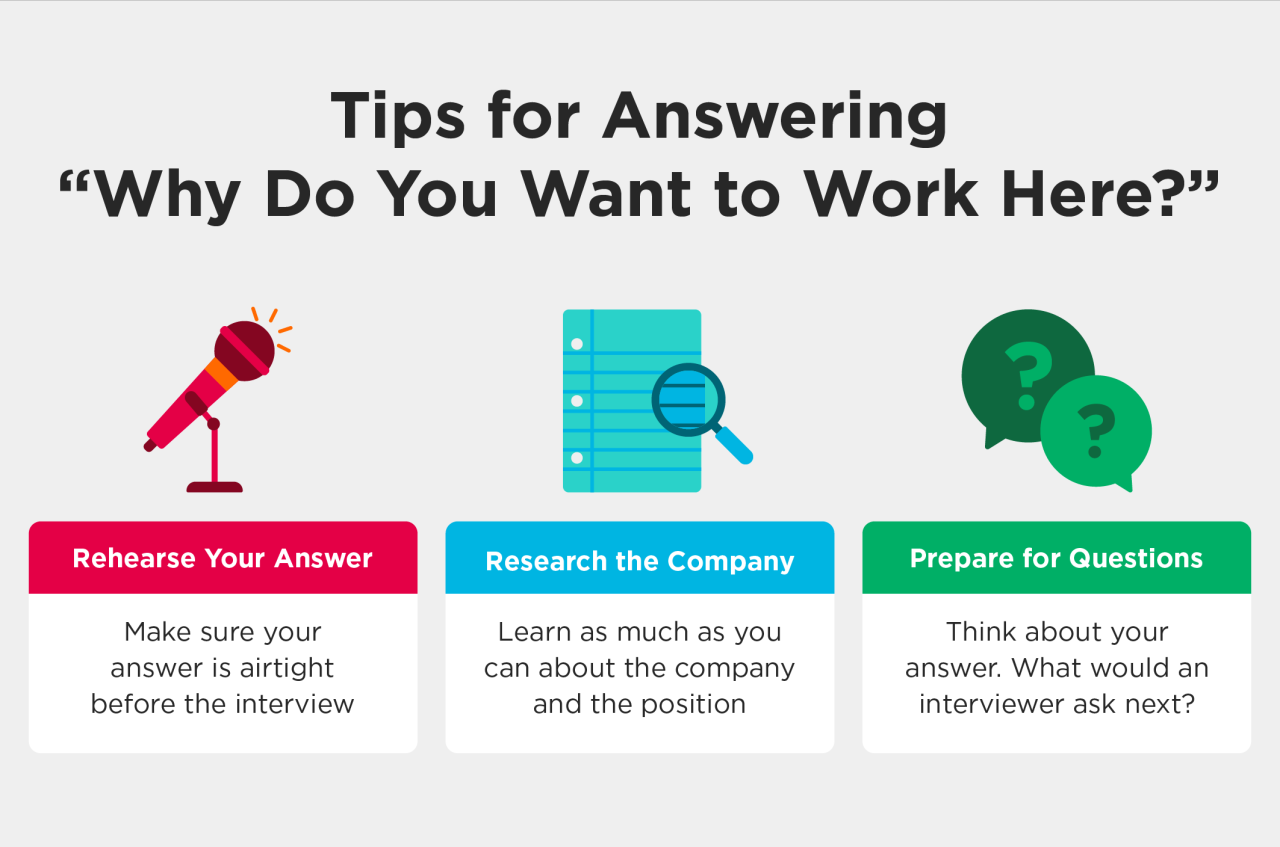

How can I improve my budgeting skills?

Improving budgeting skills can be achieved by using budgeting apps, tracking expenses diligently, and setting clear financial goals.

What is impulse spending and how can I control it?

Impulse spending is unplanned purchases driven by emotions; it can be controlled by creating a shopping list, setting a cooling-off period, and avoiding triggers.

Why is setting financial goals important?

Setting financial goals helps provide direction and motivation, making it easier to develop a structured savings plan and measure progress.

Can anyone change their spending habits?

Yes, with dedication and the right strategies, anyone can change their spending habits and build a successful saving routine.