The Hidden Costs Killing Your Wealth highlights the often-overlooked expenses that can significantly impact your financial health. These hidden costs can sneak into our daily lives, quietly draining our resources and hindering our ability to build long-term wealth. Understanding and identifying these costs is crucial for better financial decision-making and planning.

From subscription services that go unnoticed to lifestyle inflation that creeps in gradually, it’s essential to recognize how these factors play a role in our financial landscape. By shedding light on these hidden expenses, we can take proactive steps to safeguard our wealth and ensure a more secure financial future.

Understanding Hidden Costs

Hidden costs are often the unseen expenses that can significantly impact our financial well-being. These costs are not always apparent at the time of decision-making and can lead to a distorted view of the actual financial implications of our choices. Recognizing these hidden costs is essential for building and maintaining wealth over time.

The concept of hidden costs encompasses various fees and expenses that may not be immediately visible or considered when making financial decisions. These can include transaction fees, maintenance costs, and other charges that accumulate unnoticed. For instance, when purchasing a car, the sticker price may not reflect the total cost of ownership, which includes insurance, fuel, repairs, and depreciation. Similarly, in investing, transaction fees or management fees can erode returns over time, leading to less wealth accumulation than initially anticipated.

Examples of Common Hidden Costs

Understanding specific examples of hidden costs helps illustrate their impact on personal wealth. Below are several common hidden costs that individuals frequently encounter:

- Bank Fees: Monthly maintenance fees, overdraft fees, and ATM withdrawal charges can accumulate, reducing your savings over time.

- Credit Card Interest: The cost of carrying a balance on credit cards, including interest rates and late fees, can quickly add up, undermining your financial health.

- Investment Fees: Mutual funds and ETFs typically charge management fees that can significantly impact long-term returns, often without clear disclosure.

- Home Maintenance and Repairs: Owning a home incurs costs beyond the mortgage, such as property taxes, utilities, and maintenance, which can be substantial and often unforeseen.

- Subscription Services: Monthly fees for services that go unused can quietly drain your finances, making it essential to regularly review your subscriptions.

These hidden costs can have a compounding effect on your finances. For example, a monthly bank fee of $15 might seem insignificant, but over the course of a year, that amounts to $180, which could have been saved or invested.

“Hidden costs can act like financial leaks, draining wealth over time without our awareness.”

Impact on Long-Term Financial Planning

The implications of hidden costs stretch far beyond immediate expenses; they can distort long-term financial planning and hinder wealth accumulation. When individuals fail to account for these hidden costs, they may overestimate their financial capacity, leading to inadequate saving and investing strategies.

For instance, an individual who allocates a portion of their income into a retirement account may overlook the fees associated with the investment vehicles chosen. Over decades, these fees can result in hundreds of thousands of dollars in lost returns.

Additionally, hidden costs can also affect lifestyle choices and financial goals. An unanticipated increase in living expenses due to hidden costs may force individuals to adjust their savings plan, delaying retirement or other significant financial milestones.

In summary, recognizing and addressing hidden costs is crucial for effective financial decision-making and long-term wealth accumulation. By being aware of these expenses, individuals can make more informed choices, ultimately leading to better financial health and security.

Identifying Common Hidden Costs

Hidden costs often lurk in the shadows of our daily financial activities, silently eroding our wealth over time. Understanding how to identify these costs is crucial for effective budgeting and long-term financial planning. By analyzing our spending habits, we can unveil the unexpected expenses that may be draining our resources without our awareness.

Methods to Identify Hidden Costs in Daily Expenses

Recognizing hidden costs requires a keen eye for detail and an organized approach to tracking expenses. One effective method is to maintain a detailed expense journal that captures every purchase, no matter how small. This habit provides insight into spending patterns that may reveal unexpected costs.

Additionally, using financial tracking apps can automate this process, allowing for easy categorization of expenses. Look for trends in your spending habits over time. For example, you may find recurring small payments that add up significantly. Analyzing statements from credit cards, bank accounts, and bills can also uncover fees or charges that often go unnoticed.

The Role of Subscriptions and Memberships in Draining Finances

Subscriptions and memberships can contribute significantly to hidden costs. While they may seem harmless at first glance, their cumulative effect can be substantial.

Consider the following points to evaluate your subscriptions:

- Review all active subscriptions regularly to determine their relevance and usage. This includes streaming services, gym memberships, and magazine subscriptions.

- Take note of “free trials” that convert into paid subscriptions, often without a reminder.

- Evaluate the cost versus the value of each subscription—are you getting your money’s worth?

- Look for family or group plans that can lower costs for services you use regularly.

By conducting a thorough analysis of subscriptions, individuals can identify unnecessary expenditures and take action to reduce them.

Significance of Lifestyle Inflation and Its Hidden Costs

Lifestyle inflation refers to the tendency to increase spending as income rises, creating a cycle of escalating expenses that can be hard to break. This phenomenon can lead to hidden costs that obstruct wealth accumulation.

To understand its impact, consider these aspects:

- Examine how lifestyle upgrades, such as moving to a more expensive neighborhood or dining out frequently, can silently inflate your overall expenses.

- Recognize that the desire for status symbols—like luxury cars or designer clothing—can lead to overspending that is often justified by one’s improved financial situation.

- Take into account the long-term financial consequences of lifestyle inflation; increased expenses today can hinder savings and investment opportunities for tomorrow.

- Be mindful of peer influence that may encourage unnecessary spending based on perceived social norms.

By being aware of lifestyle inflation and its hidden costs, individuals can make more intentional choices regarding their spending and prioritize their financial goals.

Strategies to Mitigate Hidden Costs

Hidden costs can silently erode your wealth over time, making it essential to identify and tackle them effectively. By implementing strategic budgeting techniques, negotiating your bills, and reviewing your monthly expenses carefully, you can minimize these costs and strengthen your financial health. Here’s a breakdown of practical strategies that can help you mitigate these hidden expenses.

Budgeting Techniques to Uncover Hidden Expenses

A well-structured budget serves as a powerful tool to identify and manage hidden expenses. By analyzing your spending patterns closely, you can uncover areas where money is slipping through the cracks.

To start, categorize your expenses into fixed, variable, and discretionary categories. This will help you see where you might be overspending.

– Track Every Expense: Utilize apps or spreadsheets to log every transaction, no matter how small. This will provide insight into your spending habits.

– Use the 50/30/20 Rule: Allocate 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment. This can highlight areas where you might be overspending on discretionary items.

– Review Subscriptions: Regularly evaluate subscription services (streaming, magazines, etc.) to determine which ones you actually use and which you can eliminate.

“A budget is telling your money where to go instead of wondering where it went.” – John C. Maxwell

Guide for Negotiating Bills and Reducing Unnecessary Costs

Negotiating bills can often lead to significant savings. Many service providers are willing to lower rates to retain customers or match competitor offers.

– Research Competitors: Have alternative offers handy to leverage during negotiations. Knowing what others charge can give you an edge.

– Call Customer Service: Approach the conversation with a friendly attitude. Politely ask if there are any discounts or promotions available.

– Be Prepared to Switch: If your provider is unwilling to budge, be ready to switch to a competitor. Highlight this possibility to encourage negotiation.

– Review Annual Bills: Look at home insurance, internet, and phone plans annually to negotiate better rates based on your loyalty and market conditions.

Checklist for Reviewing and Cutting Hidden Costs in Monthly Expenses

Creating a checklist can streamline the process of identifying and eliminating hidden costs. By regularly reviewing this list, you can ensure that you stay on top of your finances.

– Monthly Expense Review: Set a specific day each month to review your expenses against your budget.

– Identify Unused Services: Make a list of services or products you’re not using (gym memberships, streaming services) and consider canceling them.

– Evaluate the Cost of Convenience: Look at delivery fees and convenience charges that could be avoided by making adjustments in your routine.

– Grocery Spending Analysis: Consider using a meal plan to reduce impulse purchases. Track your grocery spending to identify any unnecessary purchases.

– Energy Efficiency Check: Regularly assess your home for energy efficiency. Simple changes like switching to LED bulbs can lead to significant savings on utilities.

By consistently applying these strategies, you can reveal hidden costs and take proactive steps to protect your wealth.

Long-Term Effects of Hidden Costs on Wealth

Hidden costs are often overlooked, yet they can lead to significant financial repercussions over time. As expenses compound, even seemingly minor costs can erode wealth, diminishing financial stability and future opportunities. Understanding these long-term effects is crucial for maintaining and growing personal wealth.

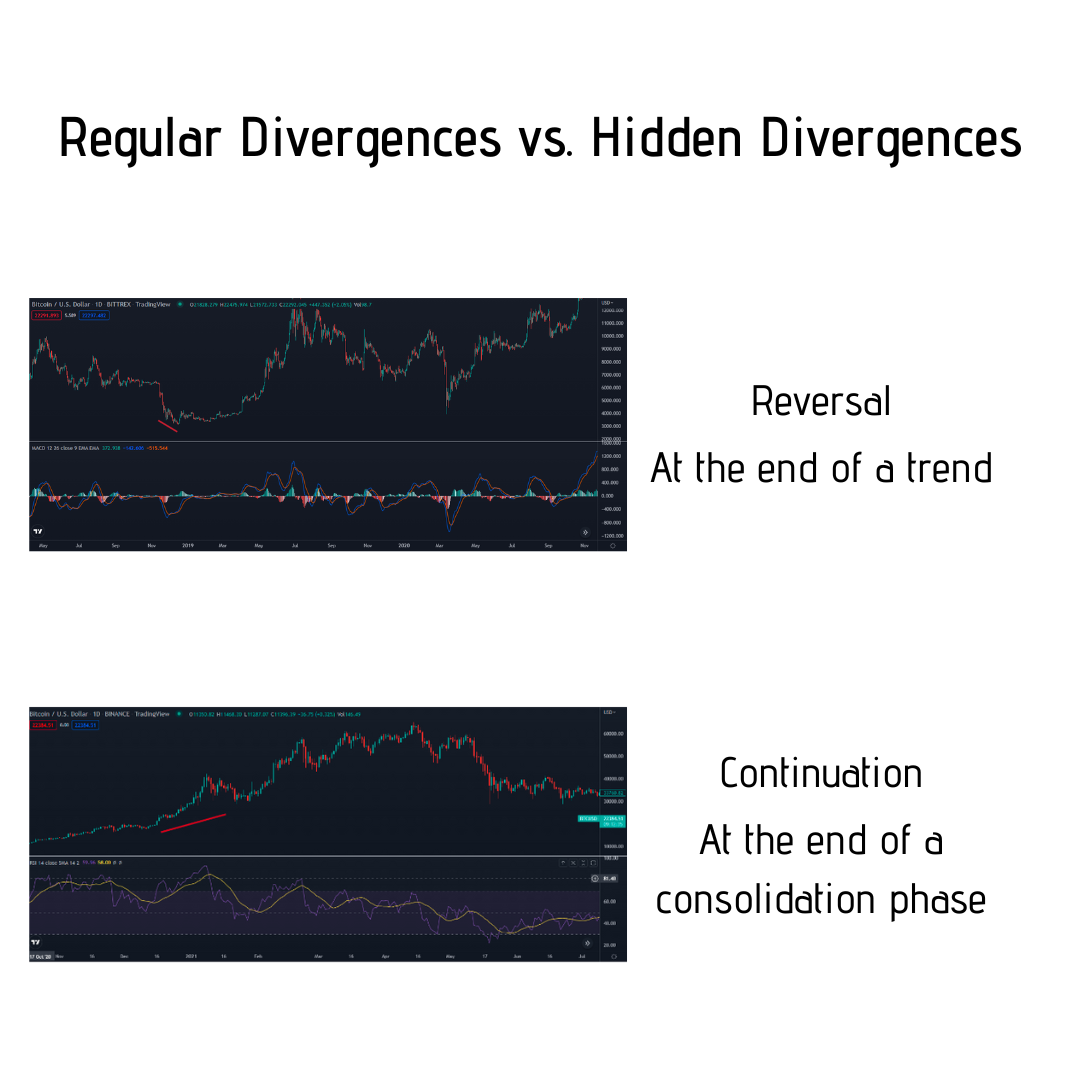

The impact of hidden costs is not always immediate; instead, they can build up and worsen over time, leading to substantial financial losses. For instance, fees associated with investment funds may appear small on a monthly basis, but when considered over a decade or more, they can drastically reduce the total returns. This compounding effect emphasizes the need to be vigilant in identifying and managing these costs to safeguard and enhance wealth.

Compounding Effects of Hidden Costs

Hidden costs can significantly impact financial outcomes, particularly through the mechanism of compounding. The following points highlight the nature of these effects:

- Long-Term Diminishment of Returns: Small fees in investment accounts can accumulate, leading to reduced total returns. A 1% annual fee may not seem significant, but over 30 years, it could erode over 28% of your investment returns.

- Inflation of Everyday Expenses: Regular hidden costs, such as maintenance fees or service charges, can inflate the overall cost of living. Over time, this can limit the amount available for savings and investments.

- Opportunity Cost: Money spent on hidden costs could have been invested elsewhere, leading to potential growth. This loss of opportunity can be particularly damaging in the long run, as compounding returns are missed.

- Debt Accumulation: Hidden interest rates or hidden fees in loans can lead borrowers to pay significantly more than anticipated, prolonging the repayment period and increasing financial stress.

Case Studies Illustrating the Impact of Hidden Costs, The Hidden Costs Killing Your Wealth

Real-life examples provide a clearer picture of how neglecting hidden costs can have detrimental long-term effects on wealth:

- Investment Fund Fees: A study by the SEC revealed that a mutual fund with a 1.5% expense ratio could ultimately cost investors around $590,000 over 30 years compared to a fund with a 0.5% ratio, assuming an average annual return of 7%.

- Credit Card Fees: One individual was surprised to find that hidden fees on their credit card, including late payment penalties and annual fees, accumulated to over $3,000 in just five years, severely impacting their financial health and credit score.

- Home Ownership Costs: A homeowner failed to account for the hidden costs of home maintenance and property taxes, which, over 20 years, totaled approximately $60,000. This neglect significantly impacted their ability to build equity and invest elsewhere.

Importance of Financial Literacy

Understanding hidden costs is critical for effective wealth management. Financial literacy empowers individuals to recognize, analyze, and mitigate these costs. The following elements illustrate the importance of financial knowledge in this context:

- Informed Decision-Making: A solid grasp of financial concepts enables individuals to make better decisions regarding investments, loans, and budgeting, reducing the chances of encountering hidden costs.

- Proactive Strategies: Financially literate individuals are more likely to seek out transparent financial products and services, thus avoiding traps associated with hidden fees and costs.

- Long-Term Planning: Understanding the effects of compounding encourages individuals to adopt a long-term perspective, prioritizing cost-effective strategies that support overall financial growth.

- Awareness of Financial Products: Individuals with financial literacy are more equipped to navigate complex financial products, enabling them to recognize and question potential hidden costs before committing.

Ending Remarks: The Hidden Costs Killing Your Wealth

In summary, addressing The Hidden Costs Killing Your Wealth is not just about trimming your budget but about fostering a mindset of financial awareness. By identifying these costs and implementing strategies to mitigate them, you can reclaim control over your finances and pave the way for a more prosperous future. Remember, it’s the small, hidden expenses that can add up over time, so stay informed and proactive in your financial journey.

Frequently Asked Questions

What are hidden costs in personal finance?

Hidden costs are expenses that aren’t immediately obvious and can impact your overall financial health, such as subscription fees or lifestyle inflation.

How can I identify hidden costs in my budget?

You can identify hidden costs by reviewing your spending habits, analyzing bank statements, and tracking monthly subscriptions.

What are some common examples of hidden costs?

Common examples include automatic renewals for subscriptions, service fees, and impulse purchases that add up.

How do hidden costs affect long-term wealth?

Hidden costs can compound over time, leading to significant financial losses that hinder wealth accumulation and savings.

What strategies can help me reduce hidden costs?

Implementing strict budgeting, negotiating bills, and regularly reviewing your expenses can help you reduce hidden costs effectively.